Top 5 Trends Multifamily Investors Need to Know in 2023 – PLUS A Bonus of 5 More!

With inflation not yet tamed and additional rate hikes ahead, albeit at a slower pace, some are still calling for a recession in the latter part of 2023. Despite the surprisingly strong employment report for January, there still remains uncertainty ahead in the form of pushback against higher rents, a record number of new units coming online, and the potential of a recession bringing slowing growth and rising unemployment. Here are the Top 5 Must-Know Trends for Multifamily Investors for 2023, and, as an added bonus, we’ve included five more to keep on the radar that we will explore in the coming months.

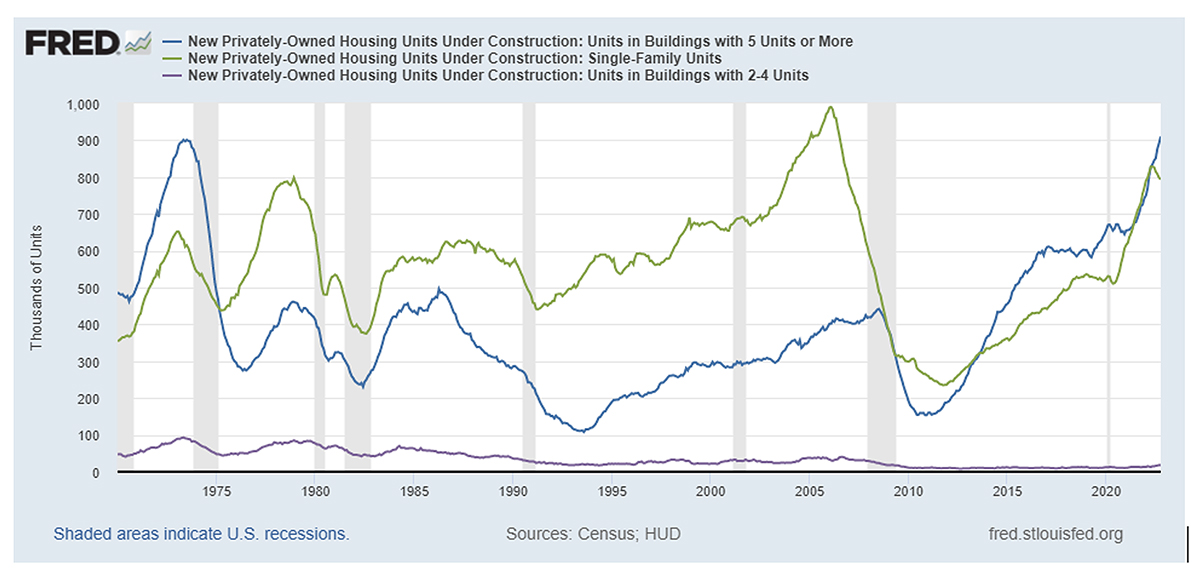

- The country currently has the highest level of multifamily units under construction in decades, which could impact some key fundamentals.

When it became apparent to multifamily developers that there was an enormous spike in demand from potential tenants eager to escape large, urban areas for the suburbs with more space to grow, developers were more than happy to provide the supply.

In fact, as of October 2022, there are over 927,000 new multifamily units under construction throughout the U.S., the highest level since the early 1970s, when the federal government began to track the number of new homes under construction. Of this total, 909,000 are in buildings with five or more units. With so many new apartment units set to hit the market in 2023 and 2024, landlords and investors should be mindful of this new competition, as it could impact both vacancies and rent growth.

More than 70% of these new units will be located in fast-growing markets in the Census regions of the South (40.8%) and the West (30.0%). The fewest units are located in the Midwest (11.9%) and Northwest (17.4%).

Multifamily Units Under Construction End of October 2022

| Census Region | Units UC | % Share |

| Northeast | 161,000 | 17.4% |

| Midwest | 110,000 | 11.9% |

| South | 378,000 | 40.8% |

| West | 278,000 | 30.0% |

| Total | 927,000 | 100.0% |

Source: U.S. Census Bureau

- Post-pandemic demand is impacting rents, especially new leases.

Despite continued growth in post-pandemic jobs and wages, more recently, households are choosing to remain in place instead of moving elsewhere. Initially, this is having an impact on new leases, but will eventually filter over to existing rents captured by the Consumer Price Index, which makes up 40% of the overall index.

According to November 2022’s RealPage Analytics, effective rents for the same rental communities nationally fell 0.59%, for the third consecutive month of declines. Meanwhile, occupancy rates have remained relatively high at 95.1%, but have fallen 20 basis points from October and 240 basis points year-over-year.

However, this softening in metrics isn’t attributed to turnover by existing residents, but rather to slowing traffic among prospective renters. In fact, 2022’s November ranking was the weakest November in eight years. While November effective rents were still up 6.5% year-over-year nationally, markets with the most tech-related jobs and located in the desert areas (such as Phoenix and Las Vegas) may soon see rent declines.

With the combination of rising vacancies and new supply coming online this year, renters with middle to higher incomes will have more options, especially for Class A multifamily apartments as well as trading urban locations for more space in a single-family rental home.

- High rents are forcing more millennials and Gen-Zers to return home.

According to a survey of 1,200 people by PropertyManagement.com, 25% of millennials are currently living with their parents, and one in eight millennials moved back in with their parents this year (also known as “boomerangs”), citing high rent, income concerns, and job losses as key reasons. Of those citing high rent as the reason for the move, 91% say they would move out of the family home if they could afford the rent.

While nearly one-third (32%) of millennial and members of Gen Z moved home in 2020 to wait out the pandemic, nearly two-thirds of them have continued to stay, citing paying down debt and saving for a home as reasons for delaying moving out on their own.

- There is a new focus on the “missing middle” for both market-rate and Low-Income Housing Tax Credit (LIHTC).

Depending on the location, some missing middle housing can be single-family homes for rent, currently estimated to make up to 10% to 15% of housing starts. There’s also a nascent trend towards using tax credits and other types of LIHTC housing funds -mainly reserved for low-income residents – to also build affordable housing for this missing middle by income (generally 80% to 120% of AMI).

- What? Three recession scenarios? Be prepared for each of them.

As of January, there are still three different economic scenarios projected as possible for 2023 – and each requires various levels of preparation.

If there is a soft landing, that would mean the Federal Reserve has been able to hike its Federal Funds rate just enough to avoid a recession, while still taming inflation. For multifamily investors, that could mean a rebound in demand as consumer sentiment improves and a gradual decline in borrowing costs depending on how quickly the Federal Reserve reverses it policy and lowers its own rate.

If there’s a shallow recession lasting a quarter or two, the Federal Reserve would face pressure to halt, or even reverse its rate hikes, as long as inflation is consistently trending lower. In this case, a rebound in demand would be delayed by at least the length of the recession, but borrowing costs could decline faster.

If there’s a deeper recession due to higher interest rates and falling demand (and more geopolitical surprises from overseas), the Federal Reserve would likely pause its hikes, or even slowly reverse them, as long as inflation was continuing to trend lower. In this case, unlike a more shallow and short-lived recession, the sharper drops in both jobs and consumer confidence in a deeper recession would act as considerable counterweights to rebounding demand, but a decline in borrowing costs could benefit deep-pocketed and patient investors.

With the start of the new year, 5 Trends thought you would find value in our take on five additional trends to keep on the radar. We will be delving into them in the coming editions:

- Look for more future competition with individually-owned multifamily and single-family rentals from institutional investors, mom and pop landlords, and Airbnb hosts frustrated with excess supply and lower vacancy levels converting to long-term rentals.

- Look for fewer sales of multifamily buildings due to higher interest rates. Instead, more owners may opt to renovate them in order to remain competitive with new supply coming online, as they hold onto low mortgage rates.

- Look for traditional multifamily demand in some large, urban areas to slowly return to pre-pandemic patterns, although this will vary as the acceptance of remote work varies between cities and states.

- Look for some pandemic-era trends to remain, such as a rising share of multifamily units in the suburbs, outlying areas of larger metros, the urban cores, and outlying areas of smaller metro areas.

- Look for long-standing, pent-up demand to continue fueling the need for more housing through the end of the decade, although this will vary greatly between cities and states.

5 Must-Know Trends for Multifamily Investors is published monthly by X-Caliber, a leading, national multifamily lenders who believes in Lending and Investing for the Greater Good.