3 W. Main St, Suite 103

Irvington, NY 10533

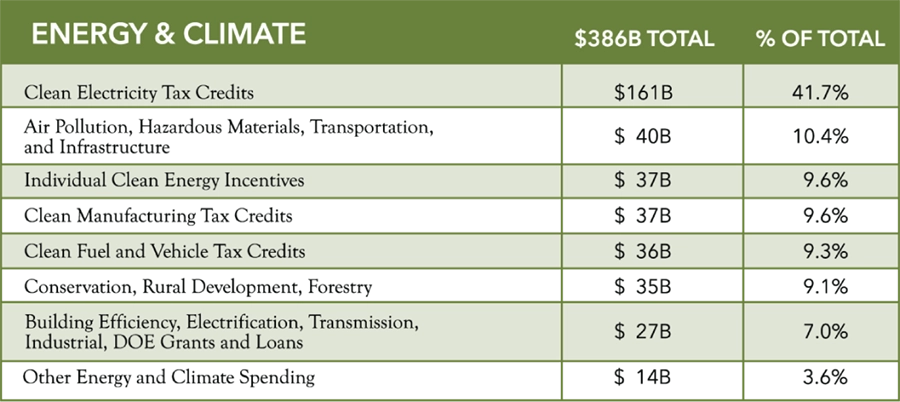

Energy & Climate

Source: https://www.crfb.org/blogs/whats-inflation-reduction-act

Knowing such programs and opportunities exist is important but not enough. Multifamily investors, owners, and developers working across the U.S. will benefit from understanding how aspects of the IRA can help maximize many tax advantages and incentives.

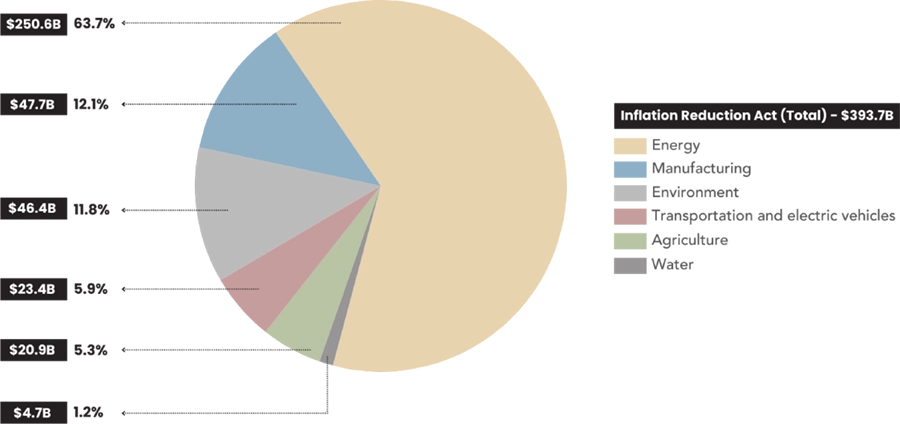

Many of the tax incentives and funds will support domestic solar panel production, wind turbines, electric vehicle (EV) charging equipment, and more. These may sound industrial, but they can often be used in connection with multifamily properties. The chart below shows a breakout of the IRA by industry, according to an analysis by McKinsey & Company.v

Breakout of the IRA by Industry

The funds are available through a mix of tax incentives, grants, and loan guarantees.

Tax Incentives

Tax incentives are directed motivation to encourage private investment in both clean energy technologies and energy-efficient building improvements.

Roughly $216 billion of the tax incentives are available to directly offset business taxes. Under the right conditions, a company can reduce its tax payments or sell the tax credits to another party. Because the IRA makes tax credits easier to monetize than in the past, it’s likely that companies will be able to use these credits as collateral for project development and construction. Sold tax credits reduce an owner’s net equity investment in a given project, enhancing returns on invested equity.

There are other financial benefits to property improvements and clean technology. They reduce operating costs. In the case of solar power or other energy generation sold into the electrical grid or to tenants, they can directly enhance revenue. The additional cash flow might take a project not yet ready for a construction or bridge loan and provide the capital to enable financing.

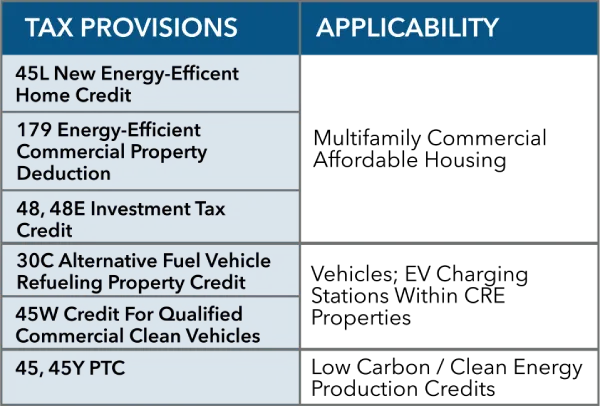

Below is a table of some of the most applicable tax incentives for multifamily owners, developers, and investors, focusing on those that apply to projects started in 2023 or later. Following the table are brief descriptions of each incentive, but you are well advised to check with your legal, accounting, and construction advisors before trying to claim any of them, as there can be many complexities and detailed requirements.

Overview of Multifamily Provisions

45L New Energy-Efficient Home Credit (Expanded)

- Effective Date: January 1, 2023

- Type of Benefit: Tax credit

- Type of Project: Qualified single-family, multifamily, and manufactured homes

- Property Qualification: Must be eligible to participate in the Energy Star Residential New Construction Program or the Energy Star Manufactured New Homes program and meet the Department of Energy’s Energy Star or Zero Energy Ready Home (ZERH) program requirements. Must pass third-party verification. Additional benefits are available for construction that meets the Department of Labor’s prevailing wage regulations.

- Who Can Qualify: An “eligible contractor,” meaning the person who constructed the energy-efficient home or the producer of an energy-efficient manufactured home

- Benefit: For a single-family or manufactured home first acquired as a residence in 2023 through 2032, $2,500 with the Energy Star qualification, or $5,000 with the ZERH qualification. For a multifamily building, including mid-rise and high-rise, there are four possibilities: Energy Star alone, $500 per unit; Energy Star and prevailing wages, $2,500 per unit; ZERH alone, $1,000; ZERH and prevailing wages, $5,000.

179D Tax Deduction: Energy-Efficient Commercial Property Deduction

- Effective Date: January 1, 2023

- Type of Benefit: Existing tax deduction updated by the IRA

- Type of Project: Qualified commercial building

- Property Qualification: Property must meet EECBP or EEBRP requirements and achieve at least 25% power cost savings.

- Who Can Qualify: Owners of qualified multifamily buildings or designers of EECBP/EEBRP* systems installed in buildings owned by specified tax-exempt entities, including certain government entities, Indian tribal governments, Alaska Native Corporations, and other tax-exempt organizations

- Benefit: For property placed into service in 2023 and after, the tax deduction is the lesser of the cost of the installed property or, instead, the savings per square foot as follows: $0.50 per square foot for a building with 25% energy savings plus an additional $0.02 per square foot for each percentage point above 25% energy savings up to a maximum of $1.00 per square foot with 50% savings. Maximum deductions increase if local prevailing wage and apprenticeship requirements are met, with an increased maximum of five times the savings per square foot (so between $2.50 and $5.00 per square foot). Expenses deducted in the prior three years (four for an allocated deduction) can reduce the maximum deduction. Taxpayers can transfer part or all of the tax savings to an unrelated third party under mutually acceptable terms and pricing.vi At the time of publication, the IRS had not yet released relevant details.

Section 48: Energy Investment Tax Credit (ITC)

- Effective Date: January 1, 2023

- Type of Benefit: Tax credit

- Type of Project: Clean energy generation and storage

- Property Qualification: Properties can involve different forms of generation, including solar and wind technologies, municipal solid waste, geothermal (electric), and tidal. Also qualifying are energy storage technologies, including microgrid controllers, fuel cells, geothermal (heat pump and direct use), combined heat & power, microturbines, and

interconnection costs. - Who Can Qualify: Taxable multifamily entities as well as certain tax-exempt entities

- Benefit: Base credits for percentages of project costs come in two categories: projects with less than 1 megawatt AC and those with greater than 1 megawatt AC. The former is 30%. The latter is 6%, but meeting prevailing wage and apprenticeship requirements can result in an additional 24%, bringing that total to 30%. Then there are additional bonuses: 10% with domestic-content minimums, 10% for placement in an energy community such as a brownfield site or area related to mining operations, and 20% for a qualified low-income residential building project or economic-benefit project. In addition, for projects with less than 5-megawatt AC in capacity, there is an additional 10% for placement in a low-income community or on Indian land.

Section 48E: Clean Electricity Investment Tax Credits

- Effective Date: January 1, 2025

- Type of Benefit: Tax credit, replacing Section 48

- Type of Project: Clean energy generation or storage

- Property Qualification: Unlike Section 48, for projects begun after December 31, 2024, requirements are technology-neutral, assuming zero-emissions operations with an anticipated greenhouse gas emissions rate anticipated to be no greater than zero. The facility must be in use for at least five years, or avoid minimum levels of carbon dioxide emissions, to avoid IRS recapture rules.

- Who Can Qualify: Taxable business entities and certain tax-exempt entities

- Benefit: Base credits for percentages of project costs come in two categories: projects that satisfy or are exempt from prevailing wage and apprenticeship requirements and those that do not satisfy and are not exempt from PWA requirements. The former sees a 30% tax credit. The latter sees 6%. Then there are additional bonuses: 10% with domestic content minimums, 10% for placement in an energy community such as a brownfield site or area related to mining operations, and 20% for a qualified low-income residential building project or economic benefit project. For projects with less than 5 megawatts AC in capacity, there is an additional 10% for placement in a low-income community or on Indian land. It can also be possible to claim “progress expenditures” if the construction period of the facility exceeds two years, but credits from those expenditures cannot be transferred, although the post-construction credits can.

Section 30C: Alternative Fuel Vehicle Refueling Property Credit

- Effective Date: January 1, 2023

- Type of Benefit: Tax credit

- Type of Project: Fueling equipment for alternative fuel vehicles, like chargers for electric vehicles. The IRA added charging stations for 2- and 3-wheeled vehicles for use on public roads, and bidirectional charging equipment (vehicle-to-grid or V2G) as eligible

- Property Qualification: Qualifying equipment must be placed in service within

low-income communities or non-urban census tracts. Original use had to begin with the taxpayer, and the property must be used primarily within the U.S. - Who Can Qualify: Businesses and individuals placing business or investment-use

refueling property into service - Benefit: The credit for qualified refueling property subject to depreciation equals 6%. Maximum credit for each single item of property is $100,000. For property not subject to depreciation, the credit is 30% of the cost with a maximum of $1,000 per item.

Section 45W: Credit for Qualified Commercial Clean Vehicles

- Effective Date: January 1, 2023

- Type of Benefit: Tax credit

- Type of Project: Plug-in electric vehicle (EV) or fuel cell vehicle (FCV)

- Property Qualification: The company or non-profit must buy the vehicle for its own use and not for resale, and use it primarily in the U.S. It must be made by a qualified manufacturer (listed on this index )viii, be subject to a depreciation allowance with an exception for vehicles put into service by a tax-exempt organization, and not subject to a lease. The vehicle cannot be allowed a credit under Section 30D or 45W. For purposes of the Clean Air Act, it must be treated as a motor vehicle primarily manufactured for use on public roads or as mobile machinery. A plug-in electric vehicle that draws significant propulsion from an electric motor with a battery capacity of at least 7 kilowatt hours if the gross vehicle weight rating (GVWR) is under 14,000 pounds,15 kilowatt hours if the GVWR is 14,000 pounds or more; or a fuel cell motor vehicle that satisfies some specific requirements.

- Who Can Qualify: Businesses and tax-exempt organizations

- Benefit: The credit is the lesser of 15% of your basis in the vehicle (30% if the vehicle is not powered by gas or diesel) or the incremental cost of the vehicle. The maximum credit is $7,500 for a qualified vehicle with a gross vehicle weight rating under 14,000 pounds or $40,000 for all other vehicles. There is no limit on the number of credits a vehicle can claim. A business can carry over a 45W credit as a general business credit.

Section 45: Renewable Electricity Production Credit

- Effective Date: January 1, 2022, under 1 megawatt; January 30, 2023, over 1 megawatt

- Type of Benefit: Tax credit

- Type of Project: Property that generates electricity from renewable sources

- Property Qualification: The property must generate electricity from qualified energy sources, which include wind, closed-loop biomass, open-loop biomass, geothermal energy, solar energy, small irrigation power, municipal solid waste, qualified hydropower production, and marine and hydrokinetic power.

- Who Can Qualify: Businesses and tax-exempt organizations that own facilities that generate electricity from qualified sources

- Benefit: Corporate tax credit of up to 1.3 cents per kilowatt-hour for electricity generated from landfill gas (LFG), open-loop biomass, municipal solid waste resources, and small irrigation power facilities, or up to 2.6 cents/kWh for electricity generated from wind, closed-loop biomass and geothermal resources. The credit is good for 10 years after the equipment is placed into service.

Section 45Y: Renewable Electricity Production Credit

- Effective Date: January 1, 2025

- Type of Benefit: Tax credit

- Type of Project: Property that generates electricity from renewable sources put into production after December 31, 2024

- Property Qualification: Unlike previous related tax credits tied to specific technologies, the new credit can be used for any type of technology so long as the facility’s carbon emissions are at or below zero.

- Who Can Qualify: Businesses and tax-exempt organizations

- Benefit: Taxpayers may be eligible for a production tax credit of at least $26 per megawatt-hour of electricity generated or 30% of energy property basis so long as they satisfy prevailing wage and apprenticeship requirements. Without the PWA qualifications, top credits are only a fifth the maximum of the PWA qualifications.

Closing

Today’s challenges for multifamily are striking and complex. Structuring deals has become difficult with high interest rates, interest rate caps, and other factors complicating financing. However, some of the above tax programs could potentially help offset enough costs to make projects possible.

For more information, get in touch with us at info@x-caliber.com.

i. Estimated Budgetary Effects of Public Law 117-169, to Provide for Reconciliation Pursuant to Title II of S. Con. Res. 14, Congressional Budget Office, September 7, 2022

ii. CBO Scores IRA with $238 Billion of Deficit Reduction, Committee for a Responsible Federal Budget, September 7, 2022

iii. 2022 Global Status Report for Buildings and Construction, UN Environment Programme, November 9, 2022

iv. Decarbonizing Commercial Real Estate, CBRE, undated

v. The Inflation Reduction Act: Here’s what’s in it, McKinsey & Company, October 24, 2022

vi. Elective Pay and Transferability, Internal Revenue Service, October 6, 2023

vii. Energy efficient commercial buildings deduction, Internal Revenue Service, October 6, 2023

viii. Manufacturers for Qualified Commercial Clean Vehicle Credit, Internal Revenue Service, September 26, 2023