3 W. Main St, Suite 103

Irvington, NY 10533

For property and building owners looking to effectively create property value while making energy efficiency upgrades, understanding all your financing options will provide you with a powerful edge to help you reach your operational goals. One program that is getting increased attention for its attractive terms is a unique financing solution called Commercial Property Assessed Clean Energy (C-PACE).

C-PACE is an alternative source of financing that allows eligible building owners to borrow money for energy efficiency, renewable energy, or other projects, such as resiliency and water conservation, and make repayments via an assessment on their property tax bill.

As property and business owners across the world are committed to finding new ways to improve efficiencies, save energy, and increase the value of their properties, C-PACE offers the opportunity to leverage its many benefits while saving potentially millions of dollars over the life of their ownership.

As energy improvements can be costly, and take time to realize their economic value, C-PACE affords the opportunity to implement efficiencies without a large capital outlay, permitting borrowers to repay the financing over the life of the improvements. In fact, financing can cover up to 100% of all hard and soft costs associated with the construction and installation of certain improvements.

What Property Types are Eligible for C-PACE Financing?

- Hospitality

- Industrial

- Office

- Retail

- Multifamily

- Agricultural

- Non-Profit

- Senior Living

- Healthcare

How Does C-PACE Work?

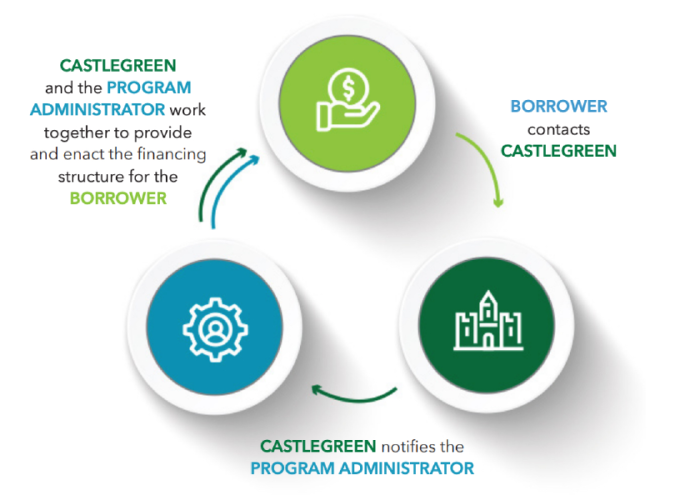

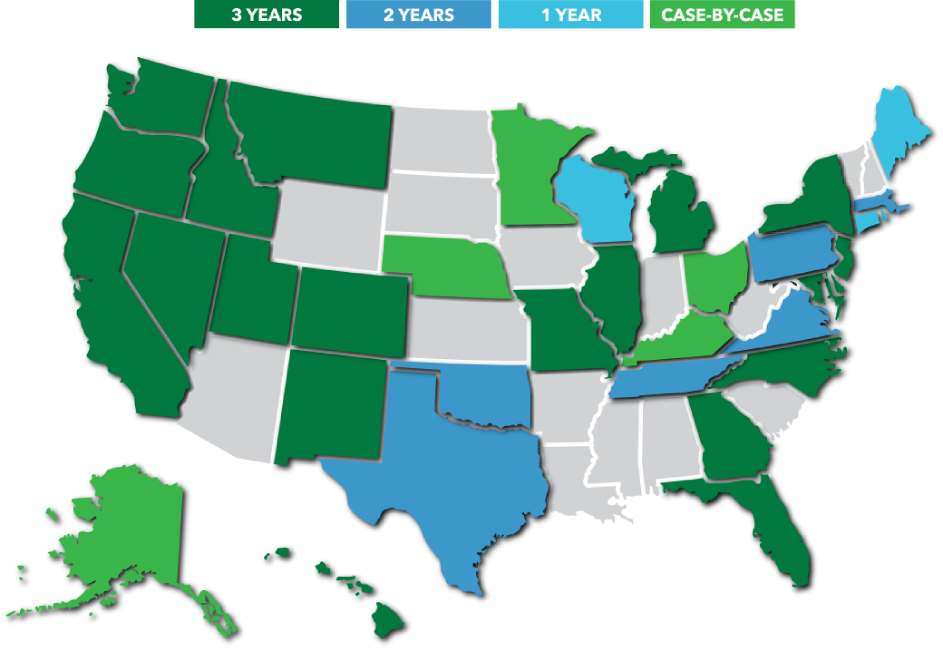

To get started, owners can confirm that C-PACE is currently available in their jurisdiction, by referencing the PACE Eligibility Map online.

Next, the owner reaches out to the capital provider who will begin the process of working with the jurisdiction program administrator. Everyone works together to effectively execute a structure that works for the borrower’s needs. Mortgage lender consent is required on all C-PACE transactions.

- Borrower: Provides comprehensive costs for all applicable and eligible retrofit or ground-up energy upgrades

- CASTLEGREEN (CAPITAL PROVIDER): Coordinates the financing structure

- Program Administrator: Approves compliance and the financing based on the elevant legislation and guidelines of the program

Ten Benefits of C-PACE Financing for Property Owners

1. C-PACE offers long-term, fixed-rate financing and provides predictability of borrowing by reducing carrying costs.

C-PACE financing can support 100% of the financing for eligible projects and improvements. C-PACE financing is similar to a property tax, allowing borrowers to treat it as an operating expense. C-PACE offers a long term (25-30 years), and a fixed rate, for the entire life of the loan.

2. C-PACE allows flexible prepayment options.

Borrowers can choose to pay down their assessment in full or in part at any time, subject to minimum prepayment terms and conditions. By paying off the assessment in full, the property owner removes the assessment from the property.

3. C-PACE is nonrecourse and does not require financial covenants.

C-PACE financing attaches to the property and is not tied to the business or owner.

4. C-PACE can provide 100% of the financing for eligible improvements.

C-PACE eligible upgrades include water efficiency, energy efficiency, and renewable energy improvements.

5. C-PACE jurisdictions may have a “lookback” feature of one to three years, providing potential access to liquidity for already completed energy-efficient improvements, without refinancing the entire capital stack.

C-PACE provides retroactive financing to recover the liquidity invested into property renovations or construction costs. For example, if the property is a hospitality asset, retroactive or “lookback”, C-PACE financing can provide carrying costs until stabilization occupancy recovers, or to repay the more expensive subordinate or mortgage debt.

6. C-PACE financing provides a low-cost alternative to expensive construction, bridge, or subordinated debt.

It is often used to close an equity gap on new construction and redevelopment costs. C-PACE financing costs are typically 50% less than mezzanine debt or equity financing costs, which typically ranges from 10% to 15%.

7. C-PACE financing transfers easily to the next property owner.

Because C-PACE financing is attached to the property, and not the business or owner, it may easily transfer at sale to the new property owner.

8. C-PACE financing provides owners efficient and affordable capital to upgrade their commercial properties while improving values and building performance.

The long-term, fixed-rate benefits of C-PACE provide affordable finance options, increasing the overall value and net operating income by quickly and effectively reducing energy costs.

9. A C-PACE and USDA loan combination provides a powerful one-two punch.

X-Caliber is the only lender to have both a C-PACE financing affiliate (CastleGreen Finance) and a USDA-licensed lender (X-Caliber Rural Capital) under one umbrella, offering a unique combination of financing that provides borrowers with lending terms that result in a non-recourse solution, with greater leverage and more competitive rates than are currently available using traditional financing products.

10. C-PACE financing provides borrowers with significant savings and increased NOI while saving energy, reducing CO2 emissions, and stimulating the economy.

When you combine the powerful elements of the C-PACE program, the project benefits on the economic side and the positive impact on the environment can also be measured to support its effectiveness.

Case Studies

How C-PACE Can Help Your Company With Local Law 97?

In an effort to reduce carbon emissions from buildings, the City of New York enacted Local Law 97 (LL97) in 2019 as a part of the Climate Mobilization Act. The law places carbon caps on most buildings larger than 25,000 square feet—roughly 50,000 residential and commercial properties across New York City. There are two initial compliance periods: 2024 – 2029 and 2030 – 2034. These caps will become more stringent over time, eventually reducing emissions 80 percent by 2050.

To date, the law is believed to be one of the most aggressive and ambitious in the world, and owners of properties must find solutions now to adhere to the many components of the legislation. Failure to do so will result in substantial fines.

C-PACE can help facilitate creative, borrower-friendly solutions to finance the energy efficiency retrofits that will be necessary to comply with LL97’s stringent greenhouse gas emissions caps.

For more information about C-PACE financing and how you may be able to leverage this innovative program to achieve your business goals, please reach out to your CastleGreen Finance or X-Caliber contact or email info@castlegreenfinance.com